6 Reasons Why You Should Renew Your Car Insurance in Malaysia with iLyF

In Malaysia, having car insurance is not just a legal requirement but also a crucial financial safeguard. Under the Road Transport Act 1987, all vehicle owners must have valid car insurance to renew their road tax and legally operate their vehicles. Without insurance, drivers are not allowed on the road, and failure to comply can lead to penalties, fines, or even imprisonment. This regulation ensures that all road users have some level of financial protection in case of an accident.

Statistics show that the risk of road accidents in Malaysia is significantly high. In 2023 alone, there were 598,635 reported road accidents, with 5,984 fatal crashes leading to 6,433 deaths. These alarming numbers highlight the importance of having comprehensive car insurance to protect yourself and your finances from unforeseen accidents. Whether it’s a minor fender bender or a severe collision, car insurance helps cover repair costs, medical expenses, and liability claims, preventing you from facing major financial losses.

The True Cost of Not Having Car Insurance

In Malaysia, for instance, repairing a dented bumper can cost approximately RM1,400, while scratched doors may require around RM500 for repainting.

Medical expenses resulting from car accidents can be substantial. A study indicated that 84.2% of road accident victims were hospitalized for 1 to 10 days, with an average medical cost of RM33,002.

In the event of theft or fire, replacing a vehicle without insurance means bearing the full replacement cost, which can be financially devastating.

Additionally, if you’re at fault in an accident, you may be liable for third-party claims, covering damages to other vehicles or property, and medical costs for other parties involved. These liabilities can amount to significant sums, leading to severe financial strain.

Common Misconceptions About Car Insurance

- “I’m a safe driver; I don’t need insurance.” Even careful drivers can face accidents due to others’ mistakes or unpredictable road conditions. Without insurance, repair and medical costs fall entirely on you.

- “Third-party insurance is enough.” Third-party coverage only protects others—not your own car. If your vehicle gets stolen, damaged, or catches fire, you won’t be compensated without comprehensive insurance.

- “Car insurance is too expensive.” Many assume full coverage is costly, but flexible plans and no-claim discounts make it affordable. The cost of an accident far outweighs the price of insurance.

- “Car color affects insurance premiums.” The color of your vehicle does not impact premiums. Insurers calculate rates based on car model, age, and driver history, not appearance.

- “Safety features reduce my insurance rates.” While security add-ons improve protection, they don’t always lower premiums. Insurers focus more on accident risk and claim history.

Clearing these misconceptions ensures you choose the right car insurance for complete protection.

Exclusive Perks of Insuring Your Car with iLyF

iLyF Car Insurance provides comprehensive coverage designed to protect drivers from financial burdens caused by accidents, theft, and unexpected vehicle damages. By partnering with top insurance providers like Zurich, Liberty, and Generali, iLyF ensures that policyholders receive the best protection tailored to their needs. Whether you’re looking for comprehensive coverage or third-party protection, iLyF offers flexible and affordable insurance plans that guarantee peace of mind on the road.

- Complete Protection – Covers damage to your own vehicle.

- Third-Party Coverage – Includes injury, death, and property damage claims.

- Windscreen & Window Protection – Covers damages including lamination and tinting film.

- Personal Accident Coverage – Provides financial assistance for injury or disability.

- 24/7 Roadside Assistance – Immediate help for breakdowns, accidents, or emergencies.

- Towing Service – Up to RM300 coverage, depending on the plan.

- Shariah-Compliant Takaful Options – Available for those preferring Islamic insurance coverage.

The benefits listed above are not exhaustive. Please review the policy wording for the full details.

How to Get Covered with iLyF

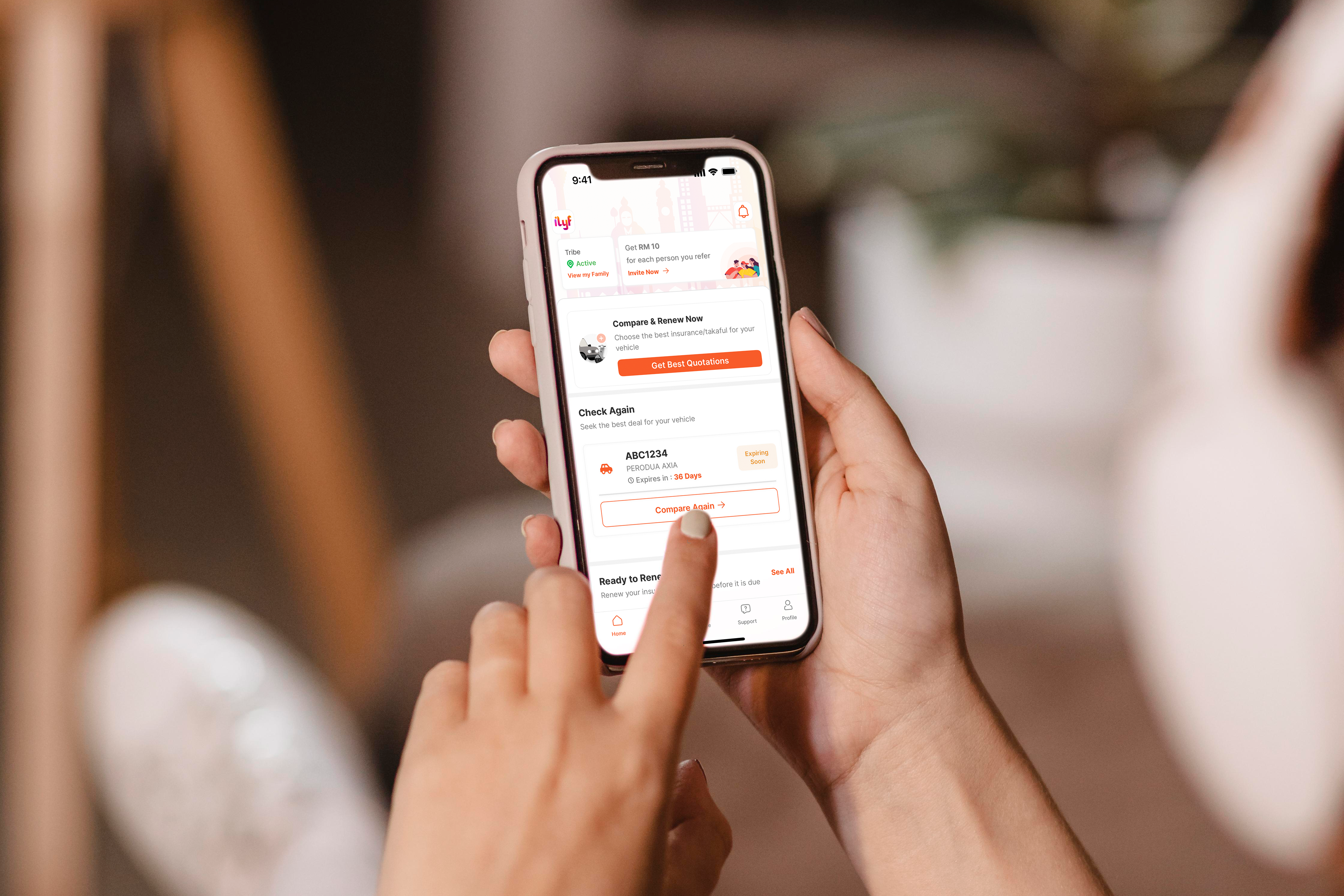

Getting insured with iLyF is quick, hassle-free, and fully digital. With a seamless process through the iLyF app, you can compare, customize, and purchase your car insurance in just a few taps.

1️⃣ Open the iLyF app and tap “Get Best Quotations” to start comparing insurance options.

2️⃣ Enter your vehicle details, including registration number, identification type, and personal information.

3️⃣ Compare insurance quotations from multiple providers and select the best plan for your needs.

4️⃣ Customize your coverage by selecting additional protection options like windscreen coverage or legal liability.

5️⃣ Complete your payment and receive your insurance cover note instantly via email and WhatsApp.

Car insurance is more than just a legal requirement—it’s a financial safeguard that protects you from high repair costs, liability claims, and unexpected accidents. With iLyF Car Insurance, you get comprehensive protection, flexible payment options, and a seamless online experience, ensuring you’re always covered without hassle.

🚗 Don’t wait until it’s too late—secure your car today with iLyF and drive with confidence.

Latest Post